Data tokens on this page

Deposit Account Services

Deposit Account Services

Reserve Investments Services

You need to know that your association is getting the most out of its reserve fund: preserving principal and improving return potential. That's why we've designed investment services that maintain investment safety while maximizing interest income to provide the most association benefit. It can be a challenge to balance safety and return with your association's short-term and long-term funding needs. Our team has the experience and expertise to provide guidance on a variety of association investment options to help.

Money Markets and CDs

Condominium, townhome, and homeowner associations have a unique responsibility to protect the financial well-being of its members. Our certificates of deposit (CD) and money market accounts can offer a reliable and safe way to help grow your association's reserve. If you're looking for a dependable tool with competitive rates and terms, we can help.

MaxSafe® Reserve

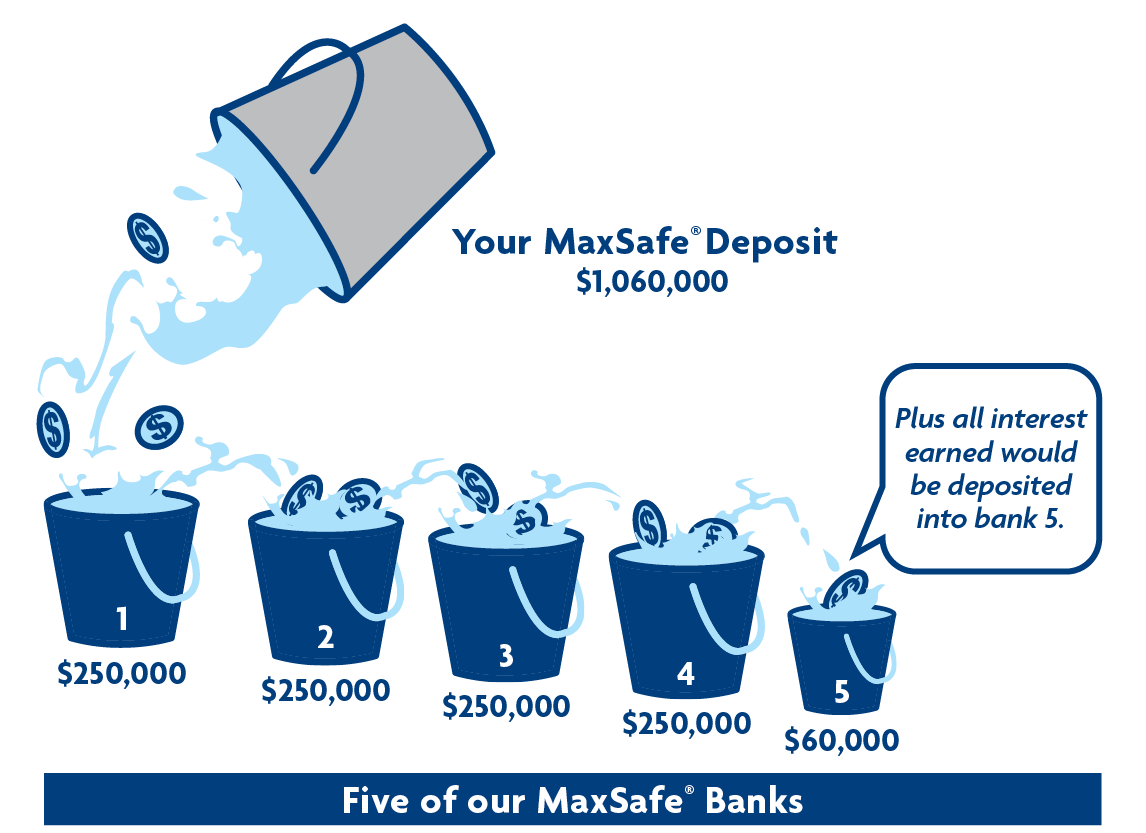

As part of the larger Wintrust family, we can offer something you won't find anywhere else: MaxSafe Reserve. Designed for associations depositing a minimum of $100,000, MaxSafe Reserve offers 16 times the Federal Deposit Insurance Corporation(FDIC) security of a normal reserve account. By depositing funds across our 16 affiliated community banks, we can insure up to $4 million per accountholder1. That's unmatched peace of mind for your association.

All participating MaxSafe banks are deemed well-capitalized by the FDIC regulatory standards. Although deposits are spread across multiple banks, you work with one financial institution, receive one statement detailing which institutions are holding your funds, and receive one year-end tax document.

OUR MAXSAFE RESERVE ACCOUNT PROVIDES:

- Increased audit control

- Maximum FDIC insurance

- Convenient check writing

- Liquidity

- Single monthly statement

- Single 1099 form

- Accurate financial reporting

- Centralized reserve investments

- Competitive return

- Added security

1. FDIC Insurance. Based on current FDIC deposit insurance coverage rules – see fdic.gov/resources/deposit-insurance/understanding-deposit-insurance/.